What is devaluation? As quickly as you drive a brand-new cars and truck off the sales lot, it immediately loses value, or diminishes. While the depreciation rate depends upon the year, make and design, typically, your automobile deserves 20% less than the original value simply one year after you have actually bought it.

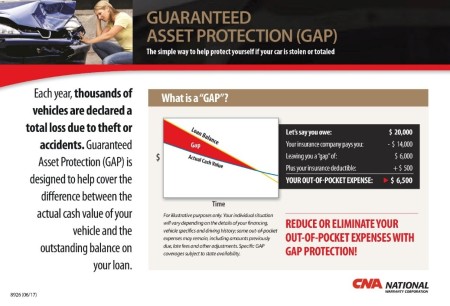

This indicates that if you have actually gotten a loan, you may owe back more money than your vehicle deserves. Go into: Gap coverage Got it up until now? Okay, here's how it works: If you enter into a mishap and your vehicle is harmed beyond repair work, your average comprehensive and crash policy will only cover the diminished worth.

Then, one year later, you get into a mishap that's considered a total loss. Your insurance will cover the diminished value, which might be 20% less than what you paid for the vehicle. Nevertheless, you still owe more on your loan than what your car policy will cover. Now, you're stuck making payments on a vehicle that you can't even drive.

What Is Gap Insurance - Route 23 Honda for Dummies

Talk with your independent agent Now that you've got the basics down, your independent insurance agent will fill you in on the rest, like coverage limits and requirements. There are also some instances in which you might currently have gap insurance protection. If you're leasing your cars and truck, gap insurance might already be included in your contract and your lease payments.

Space insurance coverage is a type of auto insurance coverage that covers the distinction between your loan balance and the existing value if your cars and truck is amounted to or stolen. is a must for every driver, but many individuals are not sure of whether extra policies such as space insurance are needed. Space represents Guaranteed Asset Protection, and while GAP insurance might not be for everyone, it can be a really important protection to have in specific scenarios.

GAP insurance coverage explained GAP insurance is a that helps cover your lorry in the event of a mishap where a car is amounted to, or in case of a vehicle theft. It offers protection by paying the difference in between what is received for an overall loss or theft from the basic auto insurance coverage, and what is still owed on the automobile.

The Only Guide to How Do I Know If I Have Gap Insurance? - New Carlisle Cdjr

: Let's state you have a balance of $25,000 on your existing auto loan. Based on depreciation your automobile is only worth $20,000. If you're involved in an accident or if your automobile is stolen, your automobile insurance policy will reimburse you for the $20,000, since that is what your cars and truck deserves.

Where to buy GAP insurance Many vehicle dealerships offer Space insurance. They make it easy to buy coverage when you purchase your automobile, and typically roll the insurance coverage premium into your monthly car payment.

There are numerous states where insurance companies immediately add GAP protection when you purchase a brand-new car, so be sure to check with your representative to see if you're currently covered. If you're not, then the coverage might be "backed" onto your policy for a sensible premium. Another benefit to acquiring space insurance with the exact same business as your main vehicle insurance is that you will only need Find more information to submit a single claim in the occasion your car is an overall loss instead of needing to file 2 claims-- one with your main insurance company and the other with your GAP insurance coverage firm.

What Does Gap Insurance Cover? - Jim Marsh Kia Can Be Fun For Everyone

The very first thing to consider is just how much you owe on your vehicle loan and if that amount goes beyond the worth of your car. If it does, and the distinction is big enough that it would be a financial concern for you to pay back to your financing business out of pocket, then GAP insurance coverage is probably a good choice for you.

GAP insurance coverage is relatively economical and getting it can save you a lot of cash and tension if a major accident or theft should take place. To find out more about other Protective products, visit our Possession Defense page.

Space insurance is generally really affordable to add to an insurance plan. Adding this type of insurance can secure you from needing to pay the difference in between your loan amount owed and ACV. For instance, if you owe $14,000 on your vehicle loan and your cars and truck's ACV is $10,000, you'll need to cover the $4,000 space between what you owe and your cars and truck's worth.

All about What Is Gap Insurance? - Iii

Who Requirements Space Insurance Coverage? Gap insurance coverage isn't a state requirement, but this add-on insurance can be helpful in particular situations. In some cases, a creditor or lienholder may require you to acquire space insurance coverage as one of the conditions for the vehicle loan. If you're questioning whether or not you need space insurance coverage, think about the following situations, in which you may gain from the included coverage.

The unfortunate reality is that individuals often put down less than that. An Edmunds analysis in 2019 discovered that the average vehicle loan down payment was 11. 7 percent. Gap insurance coverage can safeguard you in the case of the total loss of your automobile within the first couple of years if you put down less than 20 percent as a down payment.

Funded For 48 to 60 Months or Longer, Long-term funding gives you a lot of time to settle your car loan. Borrowers with long-lasting funding make lower month-to-month payments but are likewise left upside-down on their loans for longer. Car loan terms longer than four years leave a considerable quantity of time for you to be underwater on your loan.

The Main Principles Of Why You Need Gap Insurance - What Does It Cover?

Sometimes, space insurance coverage is included in the lease, however not constantly. Even if your lender doesn't require gap insurance coverage, you might wish to consider it. Acquired Car That Depreciates Faster Than Typical, The average cars and truck depreciates at a quick rate, but some cars depreciate even much faster. It is necessary to consider the model and make of your car prior to acquiring a brand-new or used vehicle.

Individuals That Drive A Lot, Greater mileage on your odometer means that your automobile's worth will depreciate faster than others. If you drive more than 15,000 miles annually, you might want to buy gap insurance coverage to protect you when it comes to a complete car loss. You Won't Be Able to Cover the Gap Expense, If you're included in an accident where your automobile can't be replaced and you still owe money on your car loan, gap insurance covers the difference between your auto loan quantity and ACV, meaning the gap insurance coverage compensation will pay the auto lending institution to settle your loan.

Even if you have terrific protective driving skills, others might not. Is your car responsible to be stolen? Space insurance can cover you in case of theft or natural catastrophes such as cyclones, wildfire, flooding, and more. Gap insurance includes protection on top of your extensive and collision insurance coverage. Comprehensive and crash insurance coverage will pay up to the current market value of your automobile.