The typical yearly cost of vehicle insurance in Florida for a 40-year-old chauffeur with a clean driving record buying a full coverage policy is $2,208. auto insurance. The state minimal car insurance coverage for the exact same 40-year-old driver would only set you back an average of $1,123 per year. Pricing varies significantly with your driving profile (prices).

Money, Geek researched ordinary insurance coverage prices in Florida based on several elements to help you comprehend exactly how these factors influence the rates. Average Cost of Car Insurance Coverage in Florida: Recap, Cash, Nerd checked out just how insurance policy rates in Florida change with details factors. Average Expense of Car Insurance in Florida: Full Protection vs. The ordinary expense of full coverage cars and truck insurance policy in Florida is $2,208 per year a considerable difference of $1,085.

Bankrate's research study can assist you recognize the average vehicle insurance coverage prices in Florida as well as the elements that influence your car insurance premium. To provide you a concept of what you could expect to pay for vehicle insurance policy in Florida, below are the typical annual costs for full coverage for some of the biggest insurance business by market share in the state. Expense of living in Florida and car insurance coverage, When buying for the ideal car insurance coverage prices in Florida, it's essential to element in.

The Only Guide to Best Cheap Car Insurance In Florida For 2022 - Usnews.com

your other expenses so expenditures you're looking at your total living costs - cars (prices) - low cost auto.

When you recognize what you desire from an insurance coverage business, you can obtain multiple quotes to assist you discover the coverage you require at a competitive cost. It is not needed by law, several motorists get various other kinds of insurance policy protection in enhancement to the compulsory PIP and residential or commercial property damage obligation insurance policy. Uninsured motorist (UM )insurance pays if you, your passengers or household participants are struck by someone who is "at mistake"and also does not have insurance, or has not enough responsibility insurance to cover the total problems suffered by you.

Make checks or money orders payable to the insurance policy company never ever to the representative or the firm. You should obtain your policy no behind 60 days after the reliable date. If you do not receive your policy, call your agent. Instantly report any type of modifications influencing your plan to your representative. This called for coverage will certainly not cover you if you are wounded in a bike crash. However, some insurance provider might use PIP and also clinical payment insurance coverage for motorcycles as extra coverage that can be acquired. In order to run or ride on a motorbike without headwear, you must more than 21 years of age

Rumored Buzz on Facts + Statistics: Auto Insurance - Iii

and also have an insurance coverage providing at the very least$ 10,000 in medical advantages for injuries suffered as a result of a crash. Bear in mind these ideas: Review your plan. Be sure you recognize your plan. If you have any type of inquiries, call your representative or the Division of Financial Solutions toll-free at 800-342-2762. The selection of insurance provider as well as representative is your own. You do not have to get automobile insurance from the dealer who marketed you the car or the borrowing establishment funding your automobile. Insurance Policy by State Florida Car Insurance Coverage Florida is a no-fault state, implying that accident targets should seek healing for damages from their insurance providers, even if the various other motorist was in charge of the crash. Bringing a claim versus the at-fault driver is difficult, otherwise difficult under the majority of scenarios - cheaper car insurance. Florida, like other no-fault states, has higher insurance policy costs than states without no-fault insurance coverage as well as is among the much more pricey states in the nation when it concerns auto insurance premiums - cheap car insurance. Florida Auto Insurance coverage Information No-fault insurance means all motorists should buy minimum Personal Injury Security(PIP)insurance coverage as well as Residential property Damage Responsibility(PDL)insurance policy.

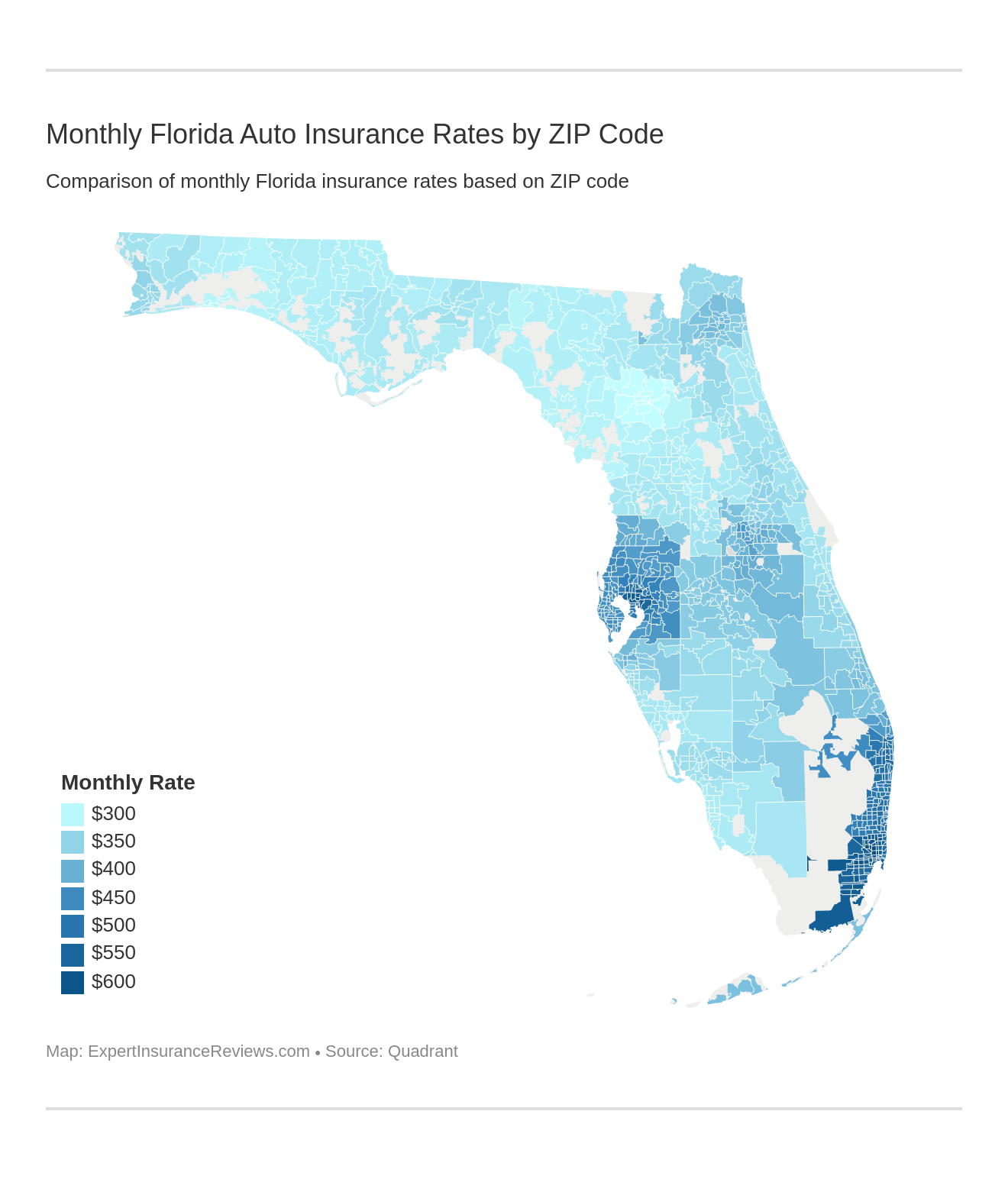

Icon-automobile with a guard and also check mark- Injury Defense insurance coverage in Florida. The General Insurance coverage auto shield icon-Fast, cost-free quotes for quick insurance coverage Injury Defense(PIP)Injury Protection Insurance coverage covers the vehicle driver as well as member of the family, along with any individual in the cars and truck at the time of the accident who does not have actually a registered lorry and also PIP coverage. That same percentage also composes the variety of foreign residents, amongst the largest in the country. Virtually 30 percent of children speak a language other than English in the home. Florida Auto Insurance & Crash Information Florida has the suspicious distinction of the state with the biggest variety of without insurance vehicle drivers. Area It's typical to pay even more for business auto protection in a larger city like Miami than a smaller city like Fort Meyers. Remember, locations that experience even more cases are normally priced greater than various other locations. Locations susceptible to weather-related occasions such as cyclones and also floodings are also aspects. Recognizing why the costs are so high to begin with can help you reduce your insurance coverage sets you back so you can delight in staying in such an amazing state (auto insurance). Why is Florida Cars And Truck Insurance Policy

So Expensive? Due to the fact that Florida requires reasonably thorough cars and truck insurance policy, lots of people question the expense of that type of coverage. Recognizing what these factors are can help you comprehend why insurance coverage is so pricey there. Populace, Florida has an incredibly high population for its dimension, which makes it a very dense state.

Personal Injury Security Need, In the state of Florida, all motorists are called for to have Individual Injury Security insurance. In Florida, there are a number of demographics that vehicle insurance coverage business consider to be high risk. It ought to be noted that demographics like this are beginning to end up being less of an aspect in vehicle insurance coverage costs as time goes on.